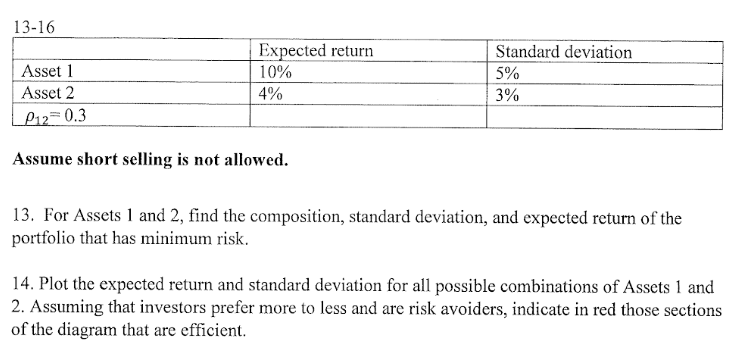

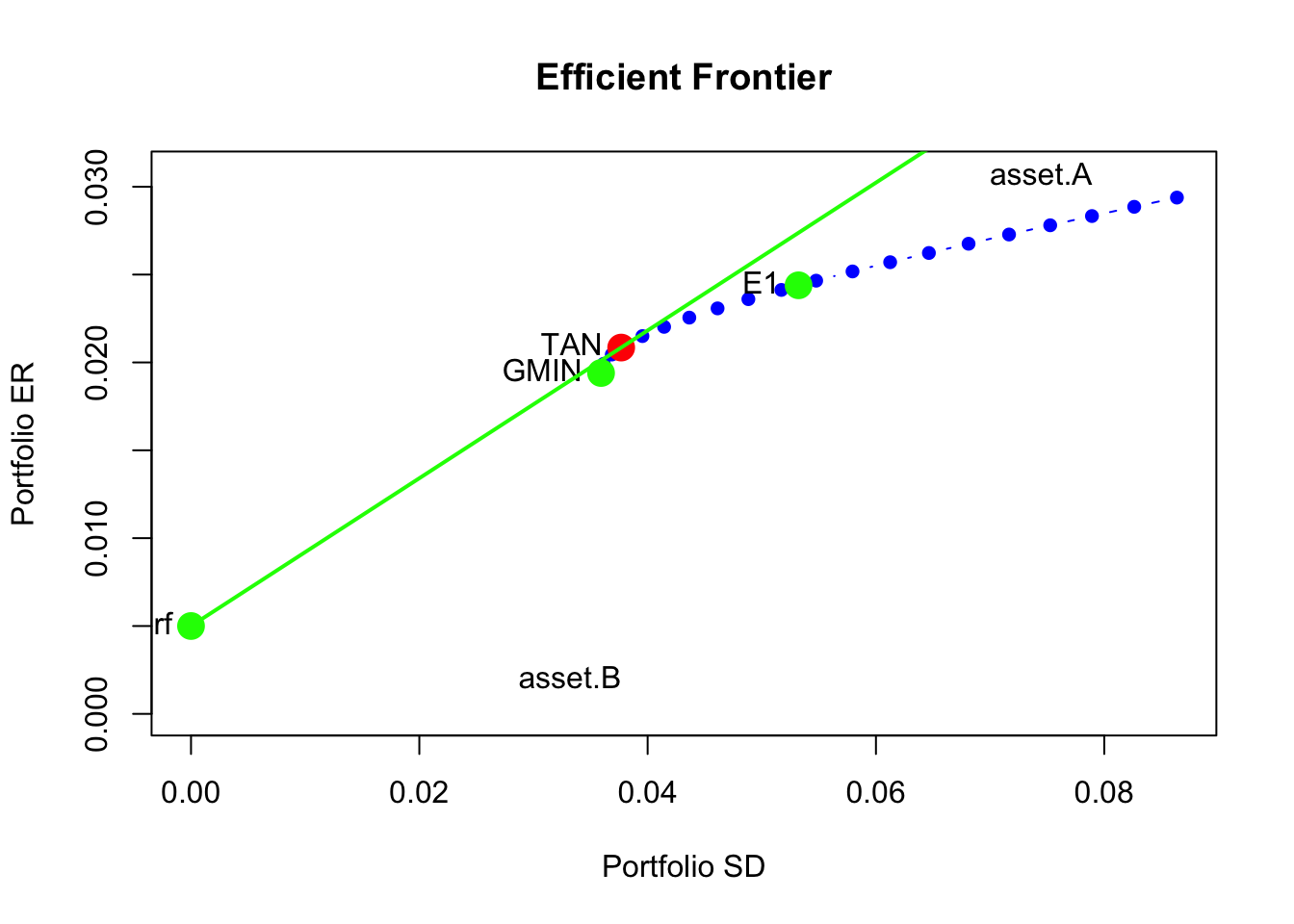

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

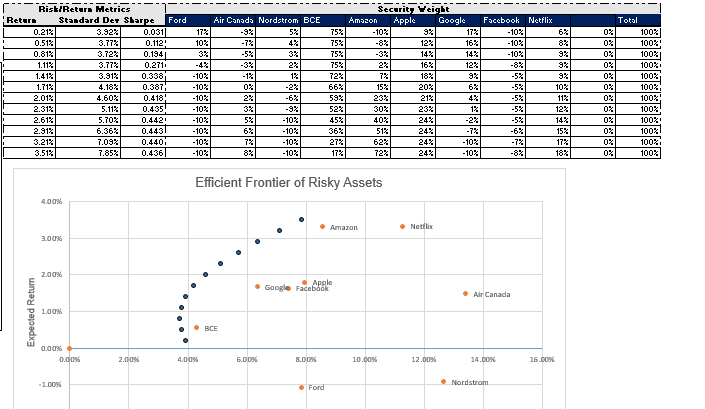

Quant Bible | Portfolio Optimization for 20 Securities Using Lagrange Multipliers, No Short-Selling, Weights Sum to 1

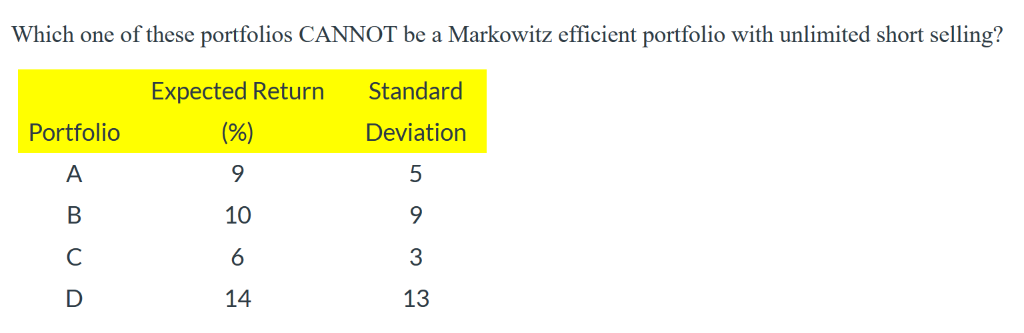

Is this methodology for finding the minimum variance portfolio with no short -selling sound? - Quantitative Finance Stack Exchange

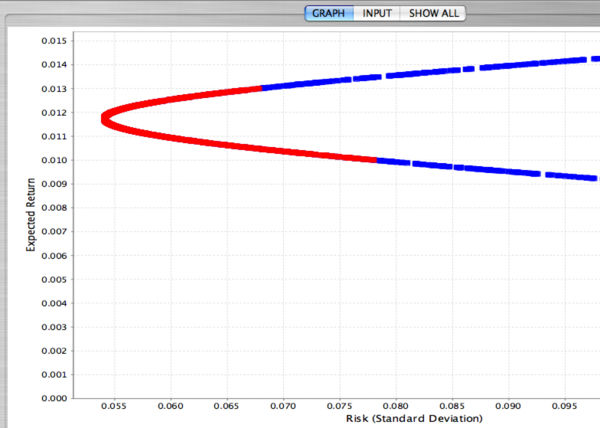

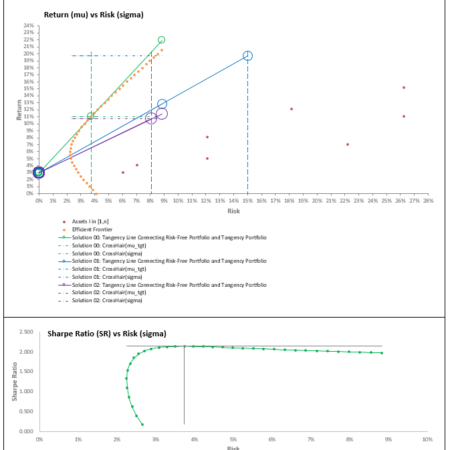

Efficient Frontier - Portfolio optimisation (optimization) with and without short-selling - File Exchange - MATLAB Central

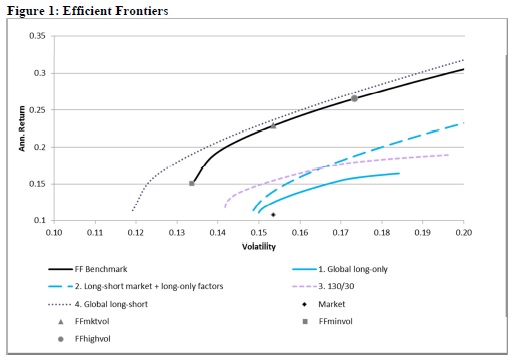

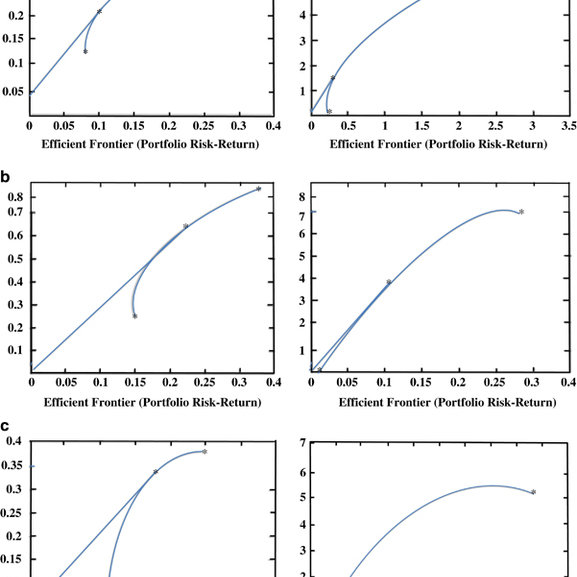

Efficient frontiers without short sales (on the left) and with short... | Download Scientific Diagram

The implications of value-at-risk and short-selling restrictions for portfolio manager performance - Journal of Risk